- Hyper localisation of products and services

- Speed and flexibility in execution

- Seamless experience backed by technology

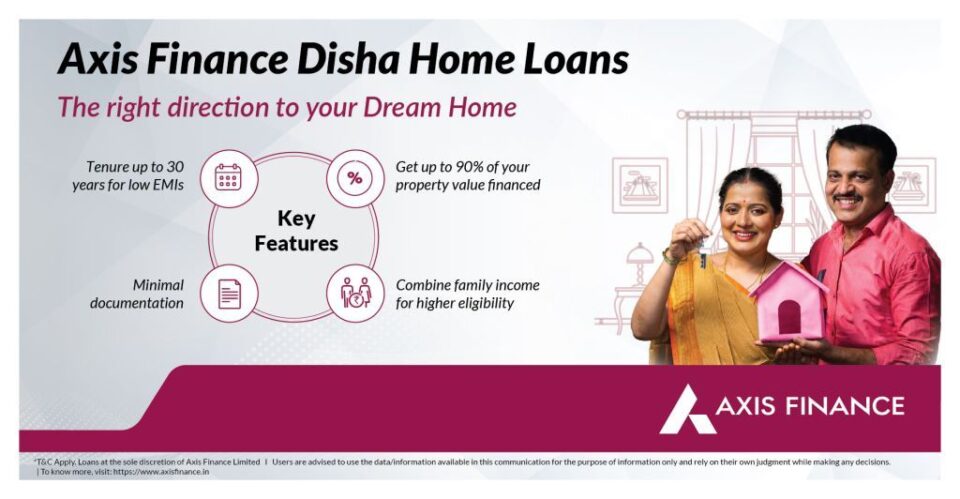

Bengaluru, April 29, 2025: Axis Finance Limited (AFL), one of India’s fastest-growing non-banking financial companies (NBFCs), today announced the launch of Axis Finance Disha Home Loans on the auspicious occasion of Akshaya Tritiya. The product is aimed at catering to the needs of aspiring homebuyers from the Economically Weaker Section (EWS) and Low-income Group (LIG) segments.

Disha Home Loans aim to provide customized home loan solutions across various geographies, with a seamless experience throughout the loan lifecycle – backed by best-in-class talent and agile systems to ensure speed in execution and responsiveness to customer needs.

This product caters to a diverse range of employment types, covering the entire spectrum of salaried (resident & NRI) and self-employed customers. It addresses the needs of individuals who have formal, semi-formal or informal income documents and are looking for financial assistance. The loan can be availed for the purchase of ready / under-construction / resale property, plot + construction, self-construction, home renovation / extension and more.

Speaking on the launch, Sai Giridhar, MD & CEO, Axis Finance, said, “The launch of ‘Axis Finance Disha Home Loans’ on the auspicious occasion of Akshaya Tritiya reflects our commitment to making home ownership more accessible. This product aims to empower individuals from economically weaker sections by bridging the financial gap and in making their dream of owning a home a reality. This is in line with the government’s relentless efforts to enhance access to housing finance in this segment. Disha Home Loans provide a wide range of customised solutions to meet the diverse needs of customers across geographies.”

He further added, “We aim to provide solutions that customers are looking for, along with superior service and transparency in our dealings. Technology and data science will be our backbone as we enter different markets across the country. Providing easy access to housing finance with a seamless experience will be our focus.”

Axis Finance has a long and successful presence in secured mortgage products with existing systems, processes, technology, talent, underwriting capabilities and a strong distribution.