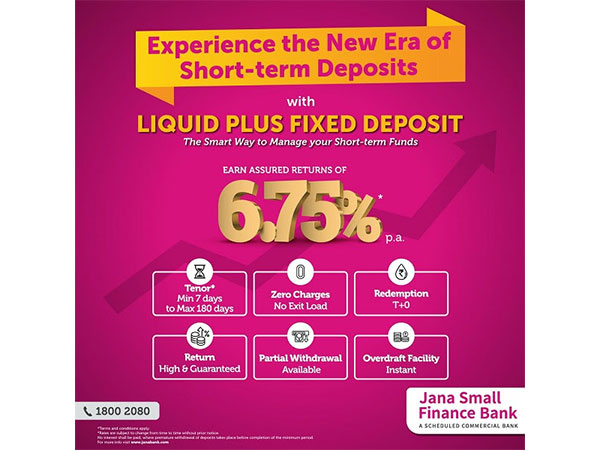

First in the industry with one of the most competitive rates for short term Fixed Deposit for a tenure of 7 to 180 Days with instant liquidity, no exit load, instant overdraft Facilities and availability of partial withdrawal

Bangalore, 19 September, 2024 – Jana Small Finance Bank, one of India’s leading small finance banks, today announced the launch of a comprehensive solution “Liquid Plus” Fixed Deposit with attractive interest rate of 6.75% p.a. for tenures ranging from 7 to 180 days. The rate is applicable for the minimum deposit amount of INR 10 Lakhs for retail deposits up to INR 3 Crores and above INR 3 Crores to INR 200 Crores for bulk deposits per customer. The liquid plus fixed deposit makes short term deployment of funds extremely easy and attractive with higher returns. The Bank has taken this step based on the feedback from customers seeking placement of short term funds.

“Liquid Plus” is designed to cater to the needs of individuals, high-net-worth individuals (HNIs) and corporates seeking short term investments options with safety, liquidity and assured returns. Apart from offering high interest rates this solution also offers innovative features like T+0 (same day) redemption, availability of partial withdrawal feature and Instant Overdraft facility as required.

Notably, there are no pre-maturity redemption charges i.e., no exit load, making it a highly flexible and beneficial fixed deposit investment option.

Speaking on this development Mr. Ajay Kanwal, Managing Director and Chief Executive Officer, Jana Small Finance Bank said, “Our aim to serve a new segment of customers who will look at short term Bank deposits meeting their needs of managing surplus money.”